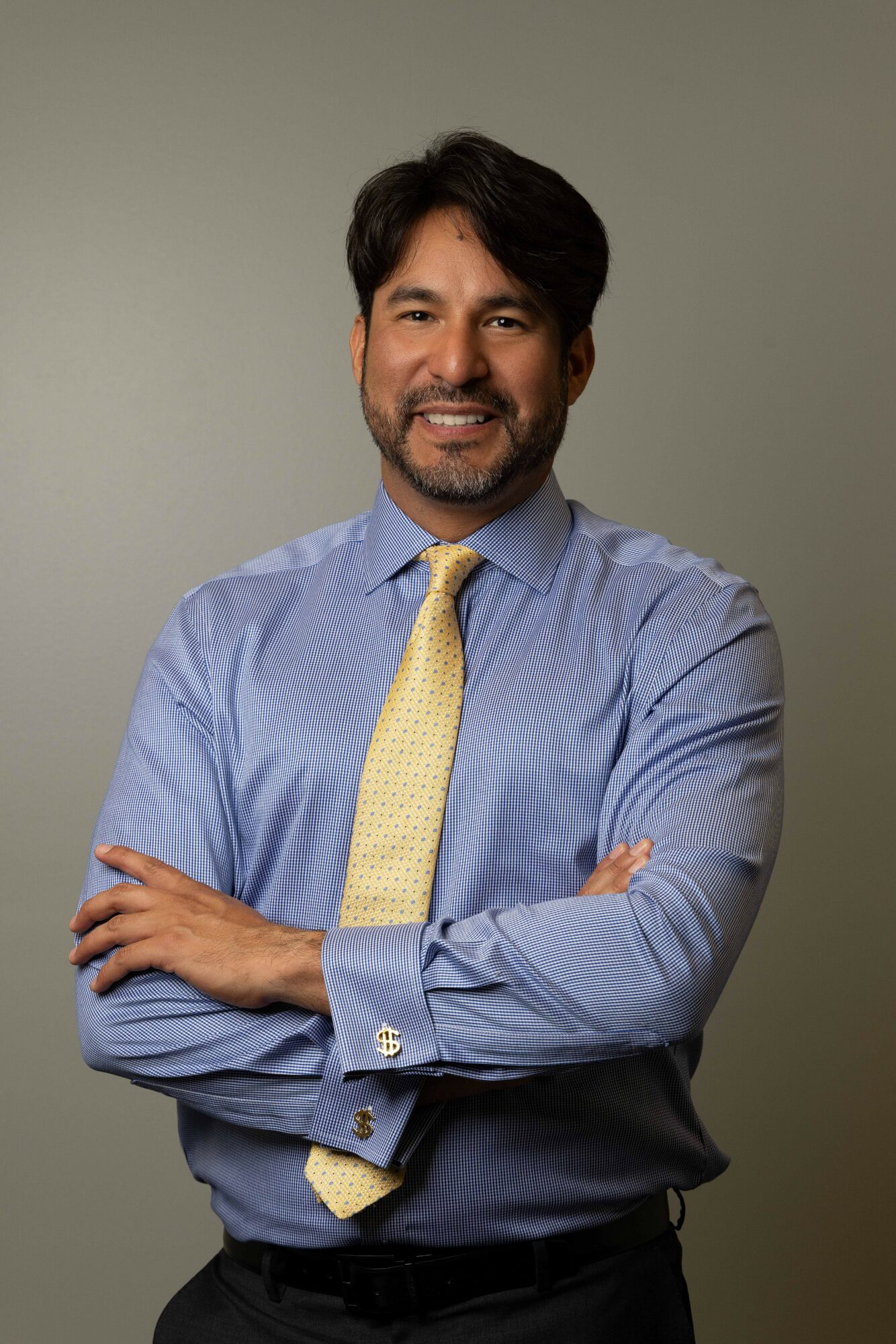

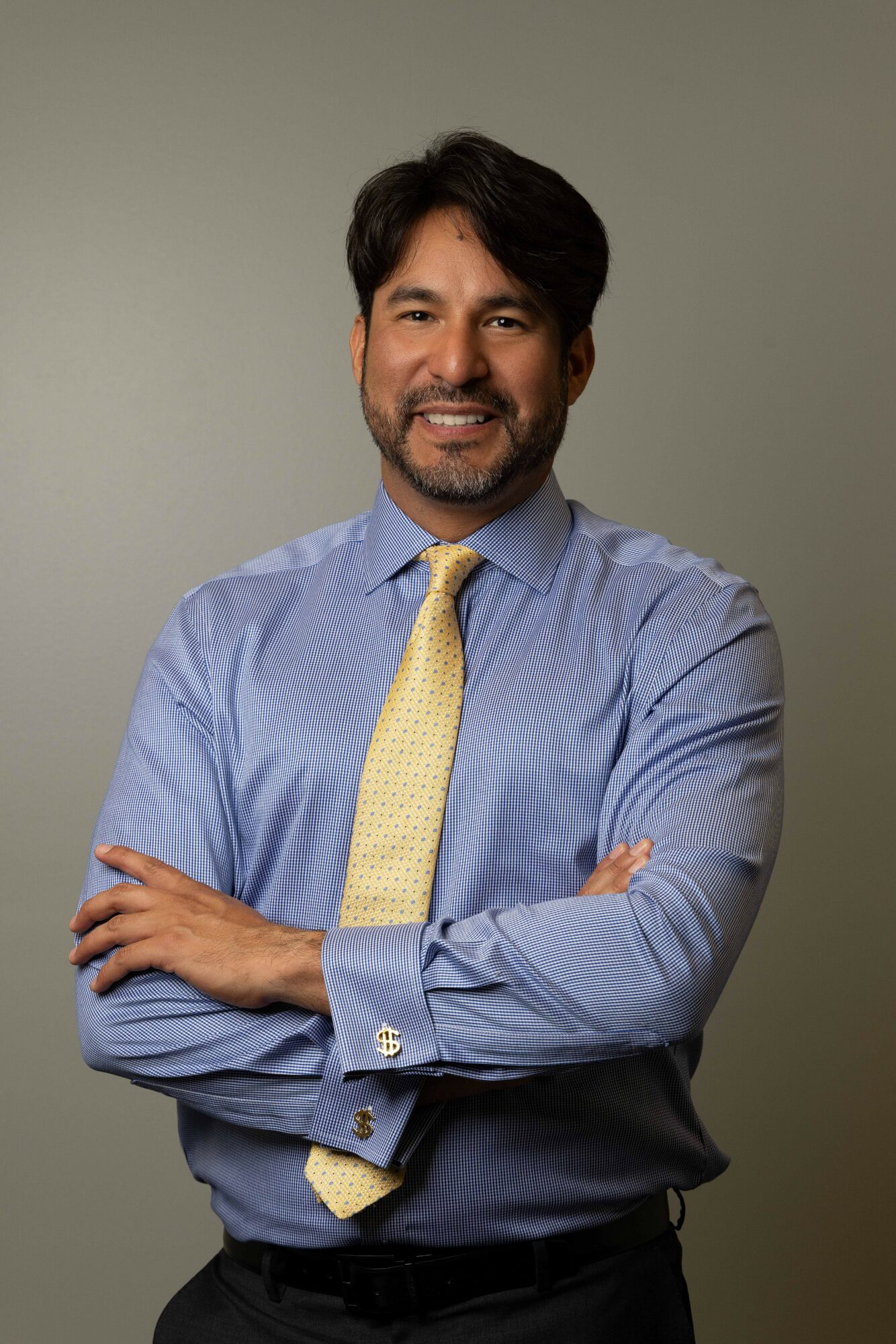

Today we’d like to introduce you to Dennis Coral.

Hi Dennis, thanks for sharing your story with us. To start, maybe you can tell our readers some of your backstory.

My story begins with a simple observation from my childhood: how differently people experienced life based on the financial decisions they made. Growing up in a family of immigrants, I saw firsthand how a well-thought-out plan could create opportunities that spanned generations. This wasn’t about just accumulating wealth, but about what that wealth could do—provide stability, education, and the freedom to pursue a meaningful life. This early lesson became the foundation of my career.

After rigorous training and learning from incredible mentors in the industry, I realized there was a gap between traditional financial advice and what people truly needed. Many advisors led with products, but I saw the conversation needed to start with the person. What does success look like for them? What keeps them up at night? That’s why I founded Coral Wealth Management. I wanted to build a practice where every strategy begins with a deep understanding of a client’s unique goals. We don’t just manage portfolios; we create a cohesive plan that aligns investment, tax, and risk management decisions with an individual’s personal definition of a successful life. It’s about helping people connect their money to their values, so they can have the confidence to live the life they’ve envisioned.

Would you say it’s been a smooth road, and if not what are some of the biggest challenges you’ve faced along the way?

Smooth roads are rare, and my journey has been no exception. The biggest challenge has been building a practice that resists the industry’s pull toward standardization. Early on, the pressure to scale quickly and lead with products was immense. It’s far easier to offer a one-size-fits-all solution, but that approach fundamentally contradicts my belief that financial planning must be personal. Earning a client’s trust by focusing on their life goals, rather than on a pre-packaged investment, requires patience and a very different kind of conversation.

Navigating volatile markets presents another ongoing challenge. During downturns, the instinct for many is to react to the noise. My role is to provide a steady hand, constantly bringing the conversation back to the long-term plan we built together. It’s about reinforcing that we planned for this uncertainty and that short-term turbulence doesn’t have to derail their life’s ambitions. This has taught me that clear, consistent communication is infinitely more valuable than trying to predict the unpredictable.

Ultimately, these struggles have shaped our firm. They reinforced the importance of prioritizing clarity over complexity and patience over speed. Every challenge is a reminder that we are stewards of our clients’ futures, which demands a commitment to continuous improvement and unwavering focus on what truly matters to them.

Alright, so let’s switch gears a bit and talk business. What should we know?

At its core, my work is to help people make smarter decisions with their money so they can live more fulfilling lives. At Coral Wealth Management, we specialize in comprehensive wealth planning. This means we don’t just focus on one piece of the puzzle, like investments. Instead, we build a complete, coordinated strategy that integrates investment management with tax awareness, retirement income design, risk management, and estate planning. The entire process is driven by one thing: our client’s unique definition of success.

I’m known for translating financial complexity into simple, actionable clarity. We start by asking questions that go deeper than just numbers, focusing on values and what truly matters to our clients. For instance, we recently worked with a business owner planning her exit. She wasn’t just looking for a transaction; she wanted to secure her family’s future, fund her next venture, and create a charitable legacy. Instead of just focusing on the sale price, we built a holistic plan that addressed the tax implications, established trusts for her children, and structured a philanthropic fund—all before designing the investment portfolio to support it.

What sets us apart is our disciplined “plan first, portfolio second” approach and our commitment to proactive communication. We believe an educated client is an empowered one. I’m most proud of the long-term partnerships we build. Being a trusted guide through life’s most significant decisions, from celebrating successes to navigating challenges, is the most rewarding part of what I do.

Where do you see things going in the next 5-10 years?

Over the next five to ten years, I believe our industry will complete its shift from being product-driven to being entirely goals-driven. Clients will expect advice that is deeply personal and coordinated across all aspects of their financial lives. The focus won’t just be on portfolio returns, but on creating a unified strategy that integrates investment, tax, and estate planning to achieve specific life outcomes.

Technology will enable this personalization at scale, allowing for highly customized, tax-aware portfolios and more sophisticated retirement income strategies that reflect today’s flexible work patterns. AI will enhance our ability to monitor and communicate, but the human element—providing clarity, empathy, and stewardship—will become even more critical. True value will be in the advisor’s ability to translate complexity into confidence.

Contact Info:

- Website: https://www.coralwm.com/

- Instagram: https://www.instagram.com/coralwealth/

- Facebook: https://www.facebook.com/coralwealth

- LinkedIn: https://www.linkedin.com/in/denniscoral

- Twitter: https://x.com/Coralwealthm

- Youtube: https://www.youtube.com/@coralwealthmanagement/featured