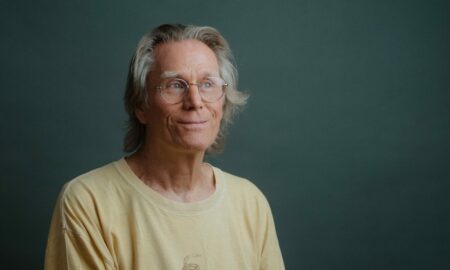

Today we’d like to introduce you to Constance Craig-Mason.

Constance, can you briefly walk us through your story – how you started and how you got to where you are today.

I was born and raised in the inner city of Baltimore, MD to a young, single mom. If I can be completely transparent, we lived in unstable home environments, impoverished, witnessing domestic violence and substance abuse. I watched my mother struggle to retain stable work, provide adequate means of the basic necessities and try to improve herself personally and professionally. She was ignorant concerning “how money works.” Therefore, the “American Dream” of the nice home with the white picket fence, with the 2-car garage and 2.5 children was certainly out of reach for her and for us. You can’t teach what you don’t know, right?

Experiencing the effects of inheriting financial illiteracy fueled me to seek more for my life. But where would I start? I mean, you don’t know what you don’t know, until you know it! As I stumbled through my latter teenage years as a young, single mom myself, I became so frustrated. The constant let downs, turn downs and disappointments were all too encompassing. I had no idea who I was, what my purpose was and to be honest where our next meal was coming from. But I knew there was a Power greater than me and if I could just tap into that then maybe some things could change. I mean, it couldn’t get much worse than being a victim of molestation, abuse, depression, loneliness, poverty, and single-motherhood all by the age of 21, right?

After years of working jobs that seemingly didn’t “feel” anything like what I thought passion and purpose should feel like, I found it! Actually, I had been unofficially doing it outside of work. As I was navigating through life, figuring things out and turning losses into lessons, I started sharing what I was learning with those in my circle. You know, family, friends, coworkers. Ok, even strangers I struck up conversations with on the bus. Don’t judge me! I was super excited about what was working for me, so how could I keep it to myself?

Everything from budgeting to credit, savings, insurance, investing, mortgage loans, real estate investing, you name it. I read EVERYTHING! My girlfriend, who was working in the financial services field, suggested that I join her in the profession. She said, “You do this anyway. Why don’t you get licensed, share what you know and earn income from it?” It took almost 7 years for me to take her up on it because I had limited daycare options. But a few years after I got married, I jumped in and went full speed ahead! It was my first successful experience with entrepreneurship, which was a chain-breaker for my family. Helping others break the chains of financial illiteracy was not just something cute to say. I was living it and teaching it simultaneously!

Financial literacy is when you have the knowledge and skillsets that allow you to make informed and effective decisions with your resources. But as a movement, it helps to promote “financial wellness”, which refers to your overall financial health. Financial well-being is a state of being where a person can fully meet current and ongoing obligations, feel secure in their financial future and is able to make choices that allow them to enjoy life. Sounds fancy, huh? In layman’s terms, it’s having financial security and freedom of choice now and in the future. Pretty dope!

On a daily basis, I spend my time much like a “Financial Therapist”! From personal experience and over 10 years of working in the financial services field, I learned that self-sabotage is a significant factor in how well we navigate life and impact the world or not. Self-sabotage shows up as negative beliefs, emotions, and habits that impeded our growth. What we believe affects how we feel and how we feel affects how we behave! I learned that once we make the shifts in our beliefs and even what we speak (affirm), we undoubtedly can have everything that we are destined to obtain personally, professionally and financially!

Overall, has it been relatively smooth? If not, what were some of the struggles along the way?

I’ve faced a lot of challenges along the journey towards “success.” Success looks and feels different for us all. For me, success equals OPTIONS! I even coined the phrase and hashtag, #OptionsIsTheNewSexy

No one likes being told, “No!” I mean say it to the nearest two-year-old and see what reaction you get back! I have had just about every “NO” you can think of, particularly related to money. I’ve been declined for everything from apartments, to cell phone contracts, cars, bank accounts, credit cards, loans, and even employment! All it did was fuel me to want my “Yes!” even more, faster!

This is exactly why I’m passionate about what I do and who I do it for. I AM my client. I’ve had to build myself from the ground up, personally and professionally, one step at a time.

Please tell us about Concierge Financial Group.

I am the CEO and Visionary of Concierge Financial Group. I am a passionate International Speaker, experienced Licensed Insurance Broker, dedicated Financial Wellness Coach and former Small Business Consultant. I have been helping individuals, families, and businesses for over 10 years. Licensed in various states, I have worked with some of the top insurance carriers to include Mass Mutual, Transamerica, State Farm, Gerber, American General, Baltimore Life, and Primerica.

As a Financial Wellness Coach, I marry positive beliefs, emotions & daily money habits with financial literacy fostering a shift in my client’s financial well-being! I’m likened to a “Financial Therapist!” I provide a full Financial Analysis that includes spending plan, short & long term savings, credit restoration, debt elimination, insurance protection & retirement supplement strategies. I work with my clients to develop realistic strategies that reflect their current needs and future goals, periodically following up to make sure that they are making positive strides. I help my clients to correctly manage their money, so they can live the life they want, without worrying about money!

I stand out in my field because I am not the “typical” financial professional. I bring light and color to the lives of my clients, literally and figuratively! I am their accountability partner, cheerleader, AND coach. I make learning about money fun and don’t use a lot of financial “jargon”. I’ve worked hard to build a brand that feels approachable, resourceful and empowering!

Do you look back particularly fondly on any memories from childhood?

My favorite memory from childhood is going to visit my great Aunt Marlene at her home in Chicago. My sister and I lived in Baltimore with our mom at the time. My mom was terrified of planes (she had never been on one). She did not want to go.

So, my aunt Marlene sent 2 round trip tickets for me and my sister to visit her. We were both under the age of 12 and it was our first-ever plane ride! We were scared, but we went as unaccompanied minors. And it opened our eyes to how BIG life was outside of our neighborhood.

Once there, she treated us like princesses, took us to Oprah Winfrey’s studio and a bunch of museums. She lived in a very nice condo, drove a swanky Cadillac and it just really grew my vision so much! I’ll never forget it.

Contact Info:

- Website: www.conciergefg.com

- Phone: 410-429-7176

- Email: constance@conciergefg.com

- Instagram: www.instagram.com/officialccraigmason

- Facebook: www.facebook.com/ccraigmasonta

- Other: www.linkedin.com/constancencraig

Suggest a story: VoyageMIA is built on recommendations from the community; it’s how we uncover hidden gems, so if you or someone you know deserves recognition please let us know here.