Today we’d like to introduce you to Sean Mullervy.

Hi Sean, so excited to have you with us today. What can you tell us about your story?

In early 2000, I was a 20-something, first-year financial advisor. I didn’t have any money, and didn’t know anyone who had any money. Not a good combination. The firm I worked for paid me an $18,000 draw on commission which was even worse than the $24,000 salary at the company I had just left. With the decrease in income, I had to decrease my expenses, so I moved back home with my parents. The professional wardrobe I could afford to buy consisted of only: 3 suits, 6 shirts, 12 ties, 1 watch, 1 belt, and 1 pair of shoes. The Internet was young, Social Media wasn’t born, mobile phones were new, and smartphones didn’t exist.

This job had goals and deadlines. If I didn’t acquire 5 or more planning clients (i.e. individuals or couples) within the first 10 weeks, I would immediately be terminated. If I didn’t acquire 25 or more planning clients within the first 52 weeks, I would probably be terminated. This job had no participation trophies.

My “office” was a recently cleaned-out broom closet with no window and a solid door. And, I had to share it! My officemate’s desk was so close to mine that we couldn’t open our drawers at the same time. Occasionally, colleagues walking by our open door would stop, look in, and laugh at us. All we had on our desks were: pens, pads, landline phones, phonebooks (White and Yellow Pages), and paper leads from the company.

Most of the paper leads given to us first-year advisors were, shall I say, interesting. Some of the leads were recent and qualified, but the others were what management called “refreshed”. The refreshed leads were old and recycled from former advisors, or given from current advisors who gave up on them. Those prospects had been called by multiple advisors dozens of times over the previous few years. Management often told us that “A lead is a lead is a lead” and “They’re so old they’re new”.

Back in those days, financial advisor success rates were terrible. Because of the bull market in the late 1990’s, a lot of people tried to become advisors, then found out quickly how hard it was. For new advisors, it was a sales job first, and an advising job second. Most advisors at other firms failed within the first year, and most of those survivors failed within another one. The firm I chose had the best first-year program in financial services at the time with outstanding training and support. Even with that, many of my firm’s advisors failed within the first year, and many of those survivors failed within a couple more.

One of my favorite movies is the original, award-winning Gladiator. A few months before it was released in mid-2000, my mentality was the same as the main character Maximus. I had a dream, was prepared to fight, would not be defeated, and would eventually earn my freedom. Gladiators had an unconquerable will to stay alive, and built resilience to achieve victory. Alas, I knew that many of my comrades would fall in battle.

To sum up my life at the time, I had: no money or connections, a shared closet for an office, a desk with a phone, and a stack of old leads. In addition, I was starting a business from scratch in an industry with a very low probability of success. Awesome! When I told my friends what I was doing, they thought I was crazy. Facing thousands of phone calls, hundreds of meetings, and countless rejections over the next few years, I went to the bookstore. These are the 3 books that saved me:

1. As A Man Thinketh by James Allen

2. Think And Grow Rich by Napoleon Hill

3. How To Win Friends And Influence People by Dale Carnegie

First, I realized that I’m the sum of my thoughts. Second, I learned how successful people had directed their thoughts. Third, I learned how to communicate more effectively. After some research, I created a business plan. Then, I was ready to enter the Colosseum!

After surviving my first year, and 10 more, as an employee advisor, I became an independent advisor in 2011, then transitioned my independent practice and founded Paragon Wealth Group in 2024. Rome wasn’t built in a day, and my changes took years. Success takes patience. I’ve engaged well over 10,000 investors in conversation, and have learned something from every one of them. Experience takes time.

Today, I’m living my dream. I love what I do, and I don’t feel that I work. Being a financial advisor comes naturally to me. I own a successful business with many long-time clients, and most of my new clients are referrals from existing clients or other professionals. My cold-calling days are long gone. Most importantly, I have the honor of helping people and improving lives.

Would you say it’s been a smooth road, and if not what are some of the biggest challenges you’ve faced along the way?

NO! There were too many struggles to list here.

Business isn’t fair. Life isn’t fair. Get over it! There’s no entitlement in sales. There’s no crying in sales. Save the drama for your momma! You don’t deserve anything that you don’t earn. Failure to earn something is your fault, not anyone else’s. Don’t blame others, or your circumstances! Success is an equal-opportunity employer. It doesn’t care who you are, or where you came from. Stop whining and complaining, have a goal and a plan, then work hard and smart! Fear lurks in the shadows. Adversity is around every corner. Take both of them head-on! My first manager was an officer in the U.S. Marine Corps. Improvise, adapt, overcome. Observe, then attack! My first office building didn’t have a room where I could hide from my responsibilities, pet puppy dogs, and lick ice cream cones while everything outside would magically become OK. Activity, activity, and more activity. Realize that anything is possible!

I figured out what I wanted do with my life, then didn’t let anything or anyone (including myself) stop me. I thought, then I did. My passion became my purpose and profession. Those were all key. I was emotional about my passion, but didn’t get emotional during my adversity. That was the key.

Thought inward, then energy outward. Turn setbacks into setups. Become unstoppable.

Appreciate you sharing that. What should we know about Paragon Wealth Group?

The definitions of Paragon are a model of perfection or excellence, and a perfect diamond of 100 carats or more.

“We are going to relentlessly chase perfection, knowing full well we will not catch it, because nothing is perfect. But we are going to relentlessly chase it, because in the process we will catch excellence.” -Vince Lombardi

That quote is one of the many reasons I named my firm Paragon Wealth Group. Also, paragon has been one of my favorite words ever since I learned those definitions at my father’s junior high school.

For over a quarter century, I have strived for perfection in my practice, and balance in my clients’ lives. In my firm’s logo, the P, W, and G morph into a diamond shape with perfect symmetry.

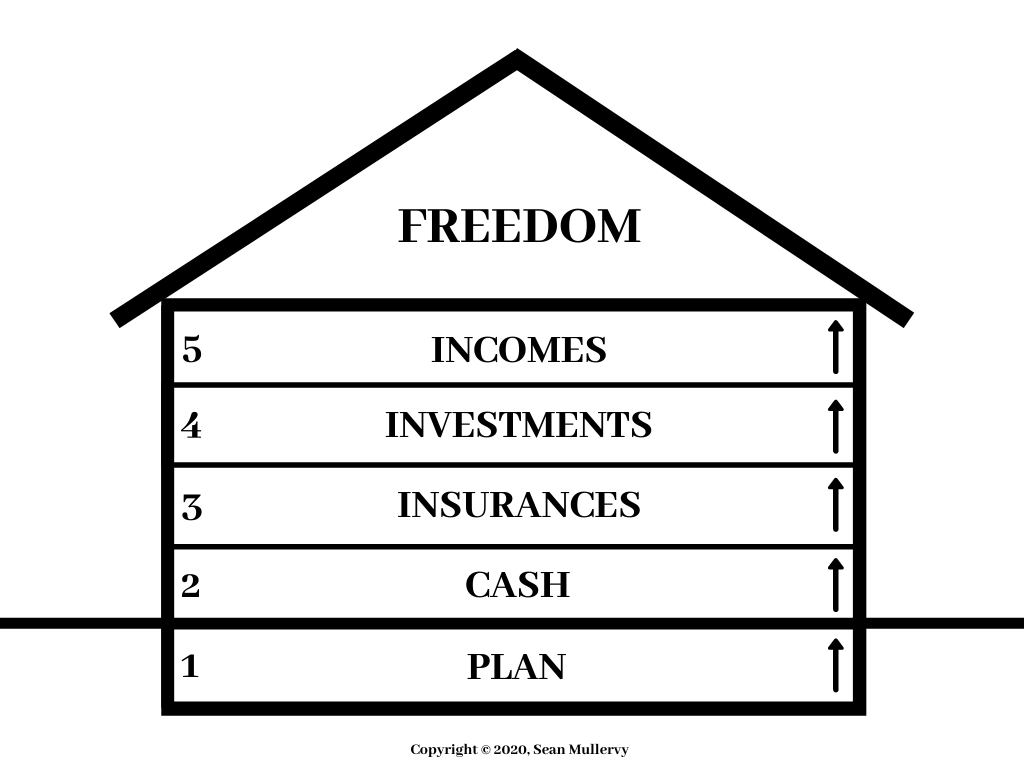

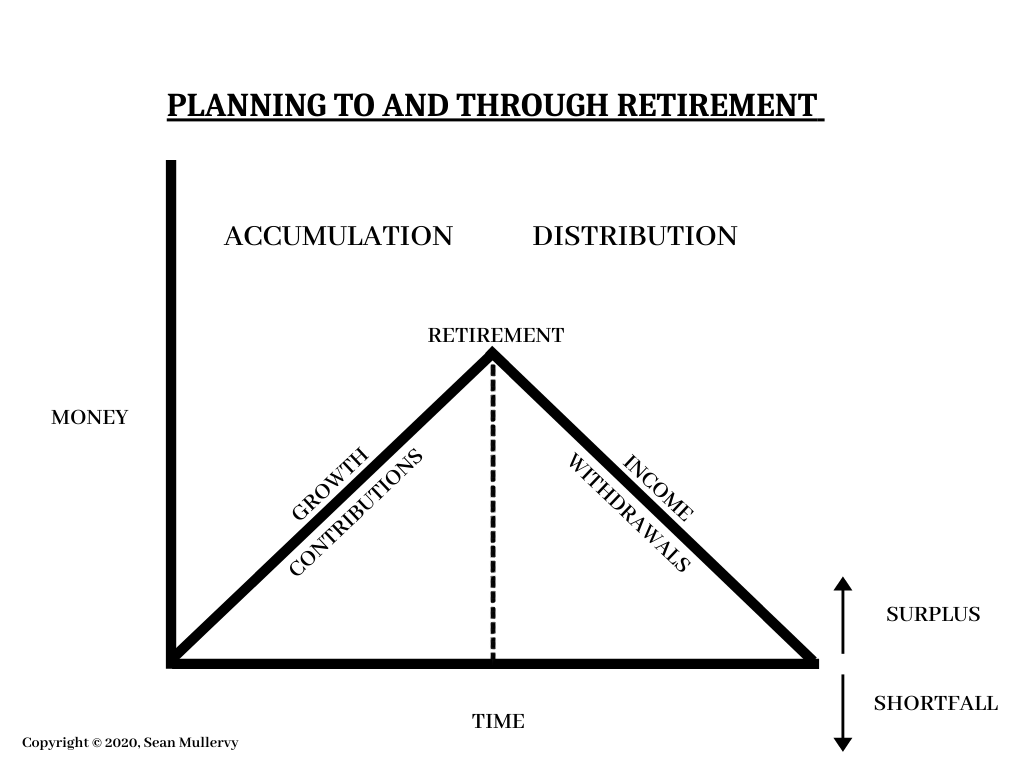

When people ask me what I do, I answer them the same way that I have answered every other person my entire career: “I help people protect and grow their assets and income.” Comprehensive financial planning. professional investment management, strategic insurance protection. PLAN. INVEST. INSURE.®

Can you share something surprising about yourself?

In the early 1990’s, I was a college radio disc jockey, and DJ’d some live events for the station. I spun old school using 12-inch vinyl records on Technics 1200 turntables with coins taped on top of the needles to weigh them down. If the record still skipped in the studio, I had a compact disc teed up in a CD player, and a large button to press play, all ready to go. CDs and players were new technologies then. To hit the trifecta of old music technologies, the station’s sponsors had all their advertisements recorded on 8-track cassettes.

For gigs outside the studio, me and another DJ had to pull albums from shelves, and file them alphabetically in milk crates, then carry the long and heavy “turntable coffin” around. I still remember searching for albums in crates at a dark venue, finding the track on the record, then blending to the new song with one ear in the wired headphones, and very little time left on the current song, all while people around me were screaming next song requests in my other ear. The struggle was real back in the day!

In the mid 2010’s, I returned to radio and hosted the Dollars And Sense show (“The show that makes sense for your dollars”) on Money Talk Radio South Florida. Then during COVID in 2020, I turned my best radio shows into chapters, and wrote the Dollars And Sense book. Soon after in 2021, I narrated that audiobook. Talking about a subject on the radio, writing about that subject in a book, and narrating about the same subject for that book, are surprisingly more different than you may think, but that’s another story.

Contact Info:

- Website: https://paragonWealthGroup.com

- Instagram: https://instagram.com/SeanMullervy

- Facebook: https://facebook.com/SeanMullervy

- LinkedIn: https://linkedin.com/in/SeanMullervy

- Twitter: https://x.com/SeanMullervy

- Other: https://amazon.com/author/seanmullervy