Today, we’d like to introduce you to Dario & Bernadine Philippe.

Hi Dario & Bernadine, we’d love for you to start by introducing yourself.

Dario: If you approached us four years ago and told us we both would be leaders within the Financial Industry, and even more crazy; business owners… We wouldn’t hesitate to let you know you’re speaking to the wrong couple.

Bernadine: It’s so true! I was an Assistant State Attorney in Broward for several years and spent some time in Insurance litigation. Entrepreneurship was the furthest thing within my career plans. But Providence is something we believe in and you never know what can push your life towards a greater mission.

Dario: When she says “Furthest”, she means Fuuuurrrthest! She left business ownership and entrepreneurship to the “crazy people”; I’m the “crazy people” she’s referring to. As for me, I’ve always been a serial entrepreneur and creative. I started out in the Ministry at my local church First Haitian Baptist Church of Pompano Beach FL and started speaking at schools and churches.

This led me to Entrepreneurship, podcasting, community board member for PBS South Florida, and authoring a book in 2019. Although, similar to Bernadine, this level of Vision we have today was not within our plans for life. A series of events happened which led us both to a mission that required both our skills and a unified passion.

Bernadine: Yep, the pandemic changed everything for us. As the world shut down and we sat home wondering what the future would bring, we dedicated our time to spending time with each other, our two kids, and deep study. Dario was learning about a heavily kept secret of the wealthy called “Family Offices” and I began learning about “Estate Planning” which is often missed in the realm of personal finances. Automatically, the conversations within our home changed from “What’s on Netflix?” to “How did the Rockefellers keep their wealth this long?”.

Dario: We were mind blown due to the amount of information we were sitting in. We developed a heart and passion for working-class Americans who never got the Blueprint to Wealth. So, to get the ball rolling, we decided to launch a YouTube show called “Family, Wealth, and Legacy Show,” where we make topics on Generational Wealth, Estate Planning, and Family Kingdom building Practical & Applicable (step by step).

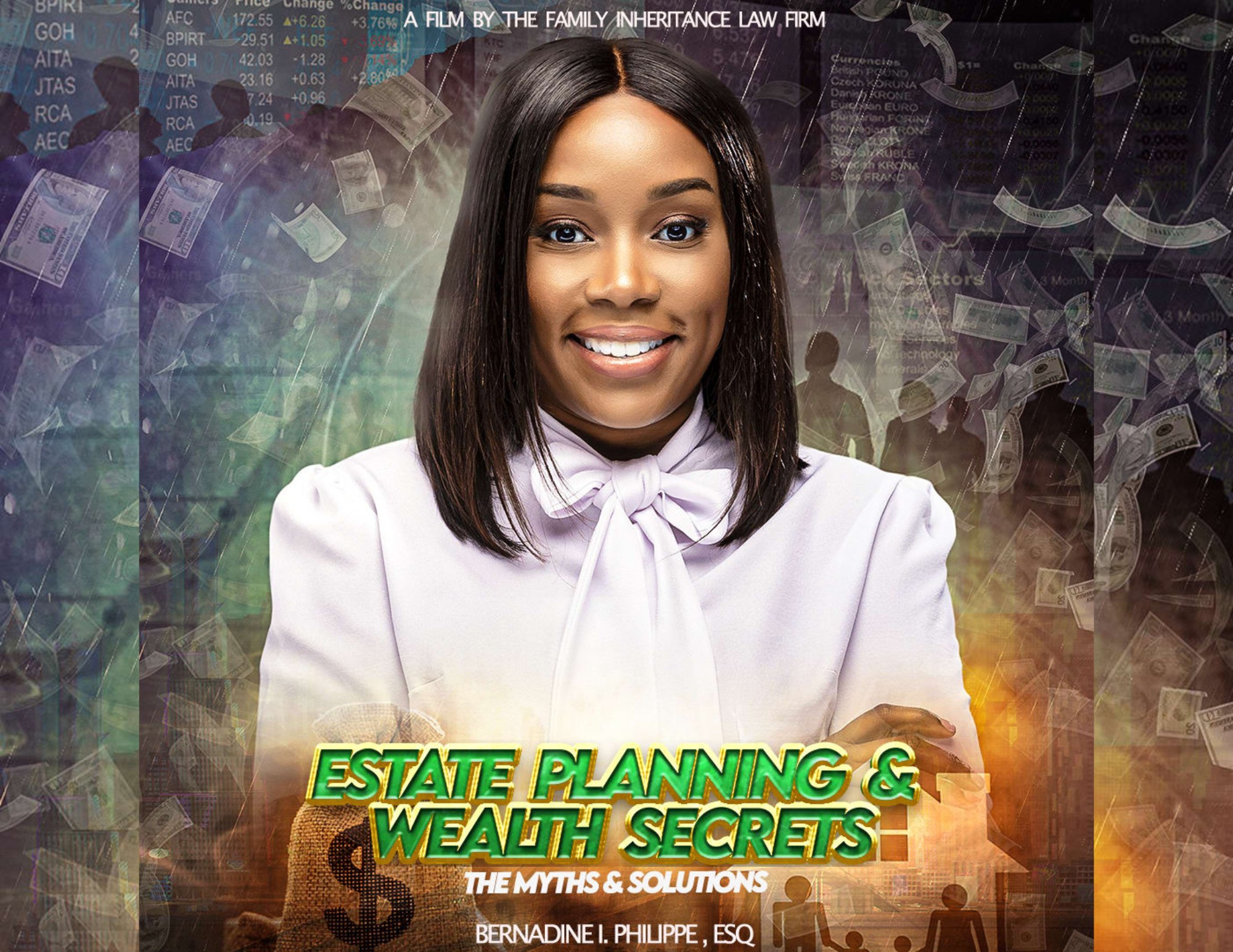

We want Generational Wealth to be a Common topic within the household & Community. Then, Bernadine started her Estate Planning Law Firm “The Family Inheritance Law Firm,” and I created a program called “The Family Office Initiative” To help 1,000 families identify, develop, and establish their own Single Family Office and Estate Planning, which are prerequisites toward Generational Wealth and an apparel brand called “Wealth On Me” where Finance Professionals and Wealth enthusiasts get cool t-shirts.

Bernadine: Phew! Yes, all of this happened within five years of 2020 and 2025. We’ve gone viral a few times and been invited to other Finance Content Creator masterminds. I also have to mention, that in the midst of all of this, we both decided to get licensed within the Financial Industry to further gain the right knowledge for our clients and gain the trust we value more than anything. I’m still learning so much more about Estate Planning, and Dario is currently working on getting several Securities licenses thanks to Brandy Avery and Davide Deberry II, who believed in our mission and are a few of our cherished guides in the industry.

Dario: Today, we tackle a bigger beast; 2053. We fell upon a research called “The Road To Zero Wealth” by the Institute for Policy Studies and Prosperity Now, which stated the “Median Black/Latino Household Wealth is on a path to Hit ZERO by 2053”. When I read this research paper, It concerned me and kept me up at night. This research was conducted in 2017, and no one saw a pandemic coming, the result of inflation, the real estate market crashing, or AI disrupting the job market. So, that 2053 projection may very much be 2030 or sooner.

Even though the research paper provided data, I still asked, “Why?” Social media has everyone selling digital products, everyone has an e-course, side hustles are common, and there are many podcasts on personal finance. So, why would the household wealth drop to zero if there’s still money being generated and opportunities still exist? I realized it was going to be due to “Misinformation.” Specifically, Misinformation

We had to do something about it. We immediately started working on a personal finance program and app called “Institute of Wealth & legacy,” where people will have access to hundreds of hours of courses and sessions on how to get out of debt, how to invest in real estate in these rough markets, credit, how to establish your own family office and more. These sessions will be taught by some of the most trustworthy and highly regarded professionals today.

Our goal is to INCREASE and SECURE the median household Wealth and Black & Latino Households by 2053. We won’t quit until we meet this mission in the next 5 years, and we will have massive promotions and partnerships to get this to the families who need financial literacy.

We all face challenges, but would you describe it as a relatively smooth road?

It’s been a great experience so far, but it’s not as smooth as we expected. With any great mission and cause, there’s its share of challenges and obstacles. One of these is that both of us are learning how to build a financial empire in an industry that’s highly guarded and led by boomers. It’s not common to see Black and Brown professionals leading within the Financial industry.

There’s a constant level of us having to “prove” ourselves within the industry. Although, the same obstacles have opened so many doors for us due to people desiring more professional and trustworthy young black men and women to help with their personal finances.

The biggest challenge for us currently is finding ways to get our mission of growing and securing the median household income before 2053 to a massive audience. This is why we are honored to have our story told here with VoyageMIA. We’re actually thankful for the challenges and obstacles because they enable us to really develop the leadership and strategy skills needed to build a strong movement.

We’ve been impressed with Family Office Ventures, but for folks who might not be as familiar, what can you share with them about what you do and what sets you apart from others?

The greatest transfer of wealth is taking place right under our noses and we believe working-class Americans should partake in it. Family Office Ventures is this company we formed to provide practical and educational systems for wealth building.

Our services include our Finance & Estate Planning department for Wills, Trusts, Health Care Surrogates, Power of Attorney, and Probate. We provide life insurance coverage, retirement plans, college funding, and investments. Our educational department is our viral program “The Family Office Initiative”, our YouTube Show “Family, Wealth, & Legacy Show”, and our soon-to-launch app “The Institute of Wealth & Legacy”.

What sets us apart is that we are the 1st Personal Development Company for Families and Personal Finance. We cover all the bases from client-based services, to education, and entertainment.

Do you have any advice for those just starting out?

Our advice to anyone starting their financial journey is to “Start Small & Give it Time”. Too often, we get clients who think they don’t have assets or any money to invest. But in reality, if you have life insurance, that’s something that can go within a trust to pass down to beneficiaries (that’s just one of many unknown assets), and you can start investing in your retirement under $50 a month. It’s all about who you’re getting your information from.

Find professionals you trust. Our clients become very close to being family due to how we feel obligated they see the benefits of working with us. For anyone desiring to get into the financial industry, this is a relationship business. Find a financial professional locally and make your interest known. Feel free to contact us if you want to get familiar with the financial industry.

Contact Info:

- Instagram: https://www.instagram.com/familyofficeventures/?hl=en

- Facebook: https://www.facebook.com/profile.php?id=100071984197949

- Youtube: https://www.youtube.com/@familywealthlegacyshow147